What are the best financial asset protection strategies in physical assets?

When it comes to financial asset protection strategies, diversification and a comprehensive approach are key. Here are some strategies to consider for protecting physical assets like precious metals, gems, real estate, farmland, and life insurance:

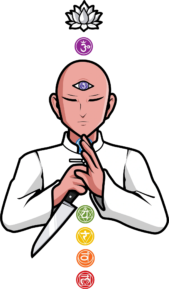

3 pillars in financial liberation

Preserve purchasing power, grow your wealth and maintain financial freedom.

Diversification

Spread your investments across different types of physical assets to minimize risk. Owning a mix of precious metals, gems, real estate, farmland, and life insurance can help protect against fluctuations in any single asset class.

Safe storage

Ensure that your physical assets are stored securely. For precious metals and gems, consider using a reputable vault or a secure storage facility. Real estate and farmland should be properly insured and maintained to protect against damage or loss.

Insurance

Obtain insurance coverage for your physical assets, such as homeowner’s insurance for real estate and farmland, or valuable item insurance for precious metals and gems. Review your policies regularly to ensure they adequately cover the full value of your assets. Whole life insurance also known as infinity banking has the most personalized options with Nelson Nash institute being the best authority. https:// infinitebanking.org/finder/

Legal structures

Consider establishing legal structures to protect your assets, such as trusts, limited liability companies (LLCs), or family partnerships. These structures can provide a layer of protection by separating your personal assets from your business or investment assets.

Estate planning

Include your physical assets in your estate planning to ensure their smooth transfer to your beneficiaries. Consult with an estate planning attorney to create a comprehensive plan that minimizes taxes and maximizes protection for your assets.

Risk management

Regularly assess and mitigate risks associated with your physical assets. Stay informed about market trends and fluctuations in the value of precious metals and gems, real estate markets, and farmland conditions. This will help you make informed decisions and take appropriate measures to protect your investments.

Professional advice

Consider consulting with financial advisors, estate planning attorneys, and other professionals with expertise in asset protection. They can provide personalized advice based on your specific circumstances and help you develop a comprehensive strategy.

Example of an investment strategy

The Dragon Portfolio: Equities (Stocks): 30%, Fixed Income (Bonds): 30%, Commodities: 20%, Currencies: 10%, Trend-Following Strategies: 10% or another example of the dragon example with reference….

The optimal portfolio, since 1929, included risk weighted combinations of Domestic Equity (24%), Fixed Income (18%), Active Long Volatility (21%), Trend Following Commodities (18%), and Physical Gold (19%). This allocation is highly unorthodox compared to a Traditional Pension Portfolio dominated by equity Linked Assets (73%) and Fixed Income (21%). https://www.rcmalternatives.com/2020/02/what-would-you-put-in-a-100-year-portfolio/

Physical financial assets can be a great source of passive income.

Here are a few examples of such assets:

Real Estate

Rental properties, such as residential or commercial buildings, can generate consistent passive income through monthly rental payments. Real estate can also appreciate in value over time, providing potential capital gains upon sale.

Dividend-Paying Stocks

Investing in dividend-paying stocks allows you to earn passive income through regular dividend payments. Dividends are a portion of a company’s profits distributed to shareholders.

Bonds

Bonds are fixed-income securities where you lend money to an entity (such as a government or corporation) for a specific period. In return, you receive regular interest payments over the bond’s term until it matures.

Peer-to-Peer Lending

Online platforms connect borrowers with lenders, allowing individuals to lend money directly to others and earn interest. Peer-to-peer lending can provide regular passive income if you diversify your loans and manage the associated risks.

Royalties

If you have creative works like books, music, patents, or trademarks, you can earn passive income through royalties. Royalties are payments made to the owner of the intellectual property when others use or license it.

Collectibles

Certain collectibles, such as rare coins, stamps, artwork, or vintage cars, can appreciate in value over time. Additionally, you may be able to earn income by leasing or renting out your collectibles to others.

It’s important to note that investing in physical financial assets involves risk and requires careful consideration and research. You should consult with financial professionals and evaluate your risk tolerance, investment goals, and time horizon before making any investment decisions.

Remember, asset protection strategies should be tailored to your individual needs and goals. It’s important to regularly review and update your strategy as your circumstances change and new opportunities or risks arise.

Safely securing and holding cypto

A very safe option is OTC transfer (person to person) with wasabi wallet such as paying someone in cash to receive their BTC thats encrypted by coinjoin using wasabi wallet which is then held in your cold storage that is only hard wired. Good device options include Trust wallet being highly regarded, ledger usb (no blue tooth) and even encrypt your own usb storage device. Tangem Wallet is another option for cold storage.

Location

Your happy place plays a big part on your health and possibly your wealth. El Salvador is leading the world in using BTC as their legal tender/currency. The ocean beaches, close knit community with farmers markets and many freedom / Liberation thinking people are being drawn there. We will keep you updated on this growing trend of health and liberation thinking ex pats moving to El Salvador.